Financial Education For Parents and Kids Today Can Help Them Live The Life They Truly Want To Live

Financial literacy means knowing how to make financial decisions. The problem is that most of us aren’t taught the fundamentals of financial literacy growing up in the classroom or from society. As a result, this lack of financial literacy knowledge and confidence can manifest itself in some incredibly challenging moments once we enter the real world.

To illustrate this view, in the United States the Financial Industry Regulatory Authority (FINRA) regularly issues a five-question test as part of its National Financial Capability Study; the test measures basic financial literacy knowledge of people all over the country.

Study participants are asked five questions covering aspects of economics and finance encountered in everyday life, such as compound interest, inflation, principles relating to risk and diversification, the relationship between bond prices and interest rates, and the impact that a shorter term can have on total interest payments over the life of a mortgage. On the most recent test given (here), only 34% of those who took the quiz got four or five questions correct.

Despite not learning much about financial literacy growing up either, what has allowed me to ignore this problem (until now) is a 10+ year career in finance working for some of the most prestigious investment banks and asset management firms in the world. Through this career I have learned the ins and outs of how our financial systems works allowing me to pick up a lot of practical lessons I never learned growing up.

The main point of change however was the birth of my daughters, Scarlett and Chloe (that’s me and Scarlett below – Chloe is just a week old right now). I realized that making sure our kids get a strong financial education is one of the most important things I can do as their dad, and so I thought long and hard about how I want to help other kids and families feel more empowered when it comes to money.

As a result of all of this, Future Funders was born with the intended goal of aiming to inspire people by giving them the financial knowledge, tools, and resources to help them live the life they want to live.

Here at Future Funders, our core belief is that every parent or child can learn how to use money as a tool to live the life they want. Three principles that are and always will be foundational to us are:

- No Fancy Jargon — We don’t believe you need a long financial career to make money work for you or your family. There are groups or companies out there who try to make the topics of money and finance overly complicated. We don’t believe in that philosophy and will not be part of that thinking.

- There Is No “Right Way” For Everyone — We all want to lead different lives, so how can we all follow the same uniform or perceived “right” money principles? We don’t believe there are uniform rules for everyone and preach ways to learn to use money as a tool in the specific life YOU want to live.

- We Have No Monopoly On Knowledge — We all want the same goal, a better financial literacy future for families. We want to encourage a community and sharing of different ways of thinking. There are a lot of great teaching resources out there and we don’t try to pretend like we have all the answers. We encourage you to share your experiences and ideas with us.

If you feel as strongly as we do about the need for financial literacy we hope that you will join us on our mission.

We invite you to subscribe to our brand new weekly newsletter below by entering your name and email (we take privacy seriously and will never spam or give out your information). We hope that it can be a benefit to your and your families.

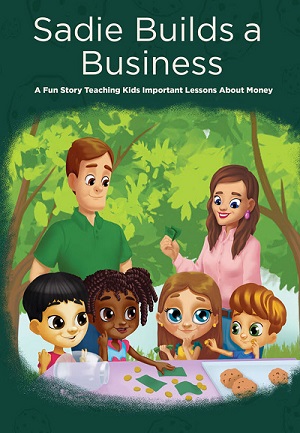

Specifically for anyone who is using Bankaroo, if you do subscribe by filling out the form at the link below, we will send you a FREE Ebook copy of our highly rated children’s book, Sadie Builds a Business. For more information on the book see below, and to learn more about us you can visit our site.

Will

CEO & Founder, Future Funders

Sadie Builds a Business Is a fun story that can be a good first start for anyone with kids age 6 to 12 looking to introduce important financial literacy principles to kids in a fun way. Even for kids below 6, they will love the illustrations and can grow into many of the financial concepts. We hope you enjoy!